Blockchain for CRE: Future Promise vs. Current Reality

Blockchain technology is largely shrouded in hype and obscured by hyperbole. Like many groundbreaking innovations, the promise of blockchain has far outpaced the practical development. It is important to understand how blockchain is being applied to the real estate market today, and how those applications are expected to mature in the future. To help cut through the haze, we offer below an overview of the current state and future promise of one of the most impactful blockchain real estate applications, real estate tokenization.

Tokenization is a catch-all term that can be applied to nearly any aspect of the blockchain industry. In this article, we will use the term “tokenization” to refer to tokenized securities. Tokenization can be simply thought of as a form of securitization, selling fractional interests using blockchain-based capital markets for liquidity instead of traditional markets such as the NYSE. This was pioneered by a trio of venture capital firms: Blockchain Capital, Science Blockchain and SPiCE VC. Each company raised capital by tokenizing their funds: either entire LP equity positions or future cash flows from investments. This process revealed benefits in liquidity, investor management and transactional efficiency that can be applied to real estate.

LIQUIDITY

Future Promise: By tokenizing an asset, the issuer gains access to an expanded pool of liquidity. Instead of being limited to the regional investors and the 9:30 AM – 4 PM trading hours of a traditional exchange, tokens trade freely across borders and at all hours of the day. This global pool of investors and round-the-clock order book will unlock additional liquidity premiums and pricing efficiency. Each of the VC fund pioneers were able to raise over $10 million for their funds, indicating positive investor demand in a nascent market.

Current Reality: There have only been one or two tokenized real estate offerings, which have not yet generated the same demand as the VC offerings. The return profile of real estate is radically different than the returns offered by blockchain companies or the VC funds that invest in them. Entreaties about the risk-adjusted returns and long-term stability of real estate vs. crypto have fallen on deaf ears. This is partly because blockchain capital markets mainly provide access to global liquidity from retail investors, who generally do not understand the benefits of diversification or risk-adjusted returns as well as institutional investors. Retail liquidity also pales in comparison to that offered by institutional investors, who so far have been barred from the market by a lack of custody, insurance, and sophisticated products.

There are many companies working on these solutions, and institutional interest from the sidelines has been extensive. Tokenization platforms like Slice RE have further prepared for the entrance of institutional investors, by tokenizing popular institutional investments like LP equity positions in commercial real estate.

INVESTOR MANAGEMENT

Future Promise: Blockchains are basically just ledgers, keeping track of who holds what token at any time. By layering on security token protocols (aka smart contracts), an issuer can automate compliance with regulations, operating agreements, PPMs and lender requirements. Lenders do not have to rely on a borrower’s good faith to inform them of changes in the capital stack. Programmable securities can automate the process of dividend payments and create software interfaces for the execution of equity rights.

Current Reality: Lenders are concerned about the commitment of small investors in highly fractionalized cap tables, and don’t yet understand the compliance benefits of smart contracts. Therefore, obtaining leverage on tokenized capital structures can be difficult. Smart contracts are new software and have suffered failures in the past as pioneers have iterated best practices. Securitize, Harbor and Polymath are leaders in the creation of secure, compliant security token protocols. They have taken up the mantle of educating institutional investors and lenders on the benefits of tokenized investment structures.

TRANSACTIONAL EFFICIENCY

Future Promise: The title to a property can be vested in a single token, reducing transactions from complex multi-party processes to a simple transfer between buyer and seller. The token’s history is publicly auditable, simplifying the title research and insurance process. Such a token can be placed into a smart contract wallet that acts as an autonomous escrow, holding the seller’s property token and the buyer and lender’s cryptocurrency proceeds in escrow until all parties assent to the exchange.

Current Reality: The real estate market is just starting to experiment with cryptocurrency transactions, with no more than a couple dozen deals completed, mostly in the residential space. Startups tackling transactional efficiency include HouseHodl, Velox.Re and Propy. This vertical will probably continue to see sluggish adoption as it requires the acceptance of institutions and the general public. Institutions will likely continue to experiment with blockchain for back-office use cases before getting comfortable enough to roll out public-facing blockchain software. Until institutional adoption and introduction, the general public is unlikely to adopt the technology on a large scale.

Current Reality: The real estate market is just starting to experiment with cryptocurrency transactions, with no more than a couple dozen deals completed, mostly in the residential space. Startups tackling transactional efficiency include HouseHodl, Velox.Re and Propy. This vertical will probably continue to see sluggish adoption as it requires the acceptance of institutions and the general public. Institutions will likely continue to experiment with blockchain for back-office use cases before getting comfortable enough to roll out public-facing blockchain software. Until institutional adoption and introduction, the general public is unlikely to adopt the technology on a large scale.

CONCLUSION

Informed, rational investors should continue to be wary of startups that promise massive disruption on short timeframes. This can be difficult in a highly volatile market, where newly-announced ventures raise tens of millions in a heartbeat from eager investors foaming (or fomo-ing) at the mouth to get in on the next big winner. Nonetheless, the achievements and progress of the pioneering startups noted in this article are laying the groundwork for new, efficient, automated, and global capital markets within the next decade. Each successful implementation eases the path for further innovation and adoption, accelerating the rate of change. Every real estate professional should keep abreast of this developing technology, or risk being left behind when it explodes into the mainstream.

This Week’s Sponsor

CBRE, a Fortune 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm based on 2017 revenue. It employs 80,000 people and serves real estate investors and occupiers through approximately 450 offices worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.

Read Next

1/23/2025

1/23/2025

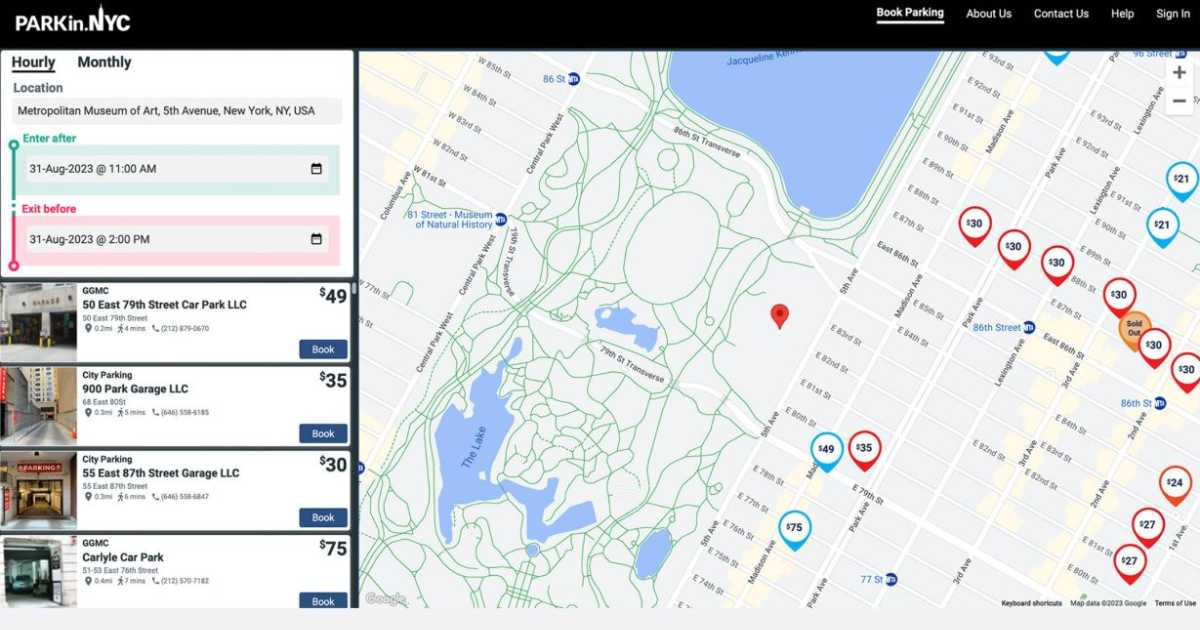

When It Comes To Managing Properties’ Parking, Technology Is Key It’s easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because it’s mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they haven’t figured out how to maximize its value.

11/22/2024

11/22/2024

Making Visitor Management a Welcome Experience If you’re in CRE, you already know the challenges of managing and tracking visitor access at your properties.

11/7/2024

11/7/2024

Shadow IT: The Hidden Threat to Real Estate Companies In today's rapidly evolving technological landscape, the emergence of Shadow IT poses significant challenges for organizations, particularly in the commercial real estate sector.

10/31/2024

10/31/2024

How Bridge Investment Group Cut Manual Data Entry and Improved Onsite Productivity In CRE, efficiency isn't just a goal; it's a necessity for survival. Leveraging technology as a means to cutting through operational drag and optimizing employee productivity has become a competitive imperative for success.