Feature

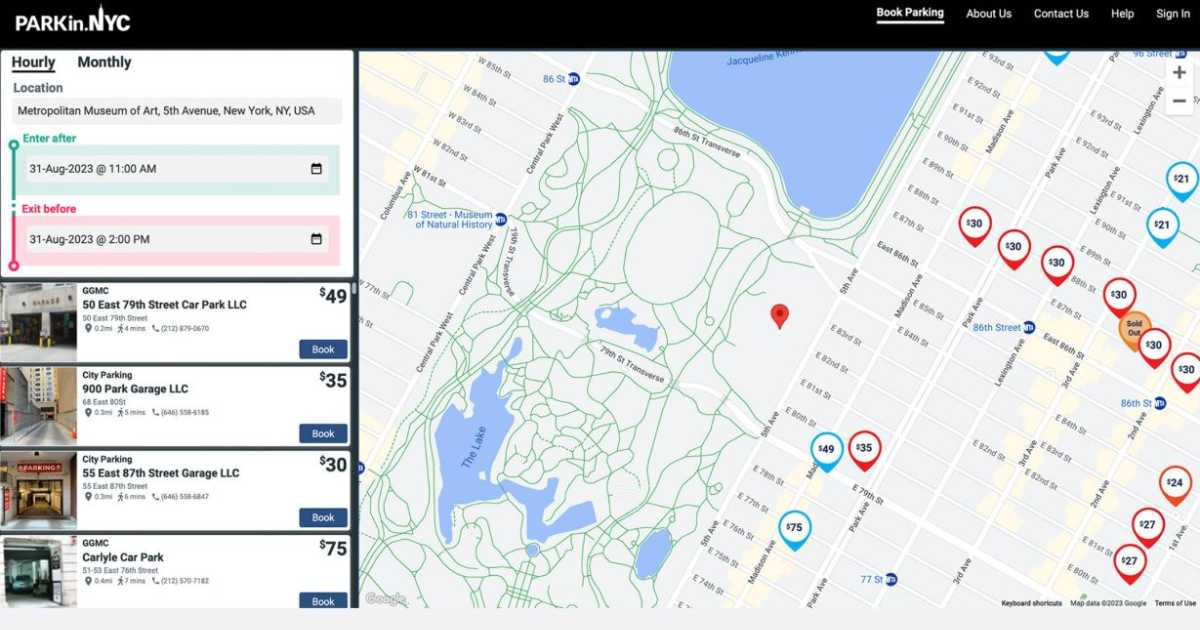

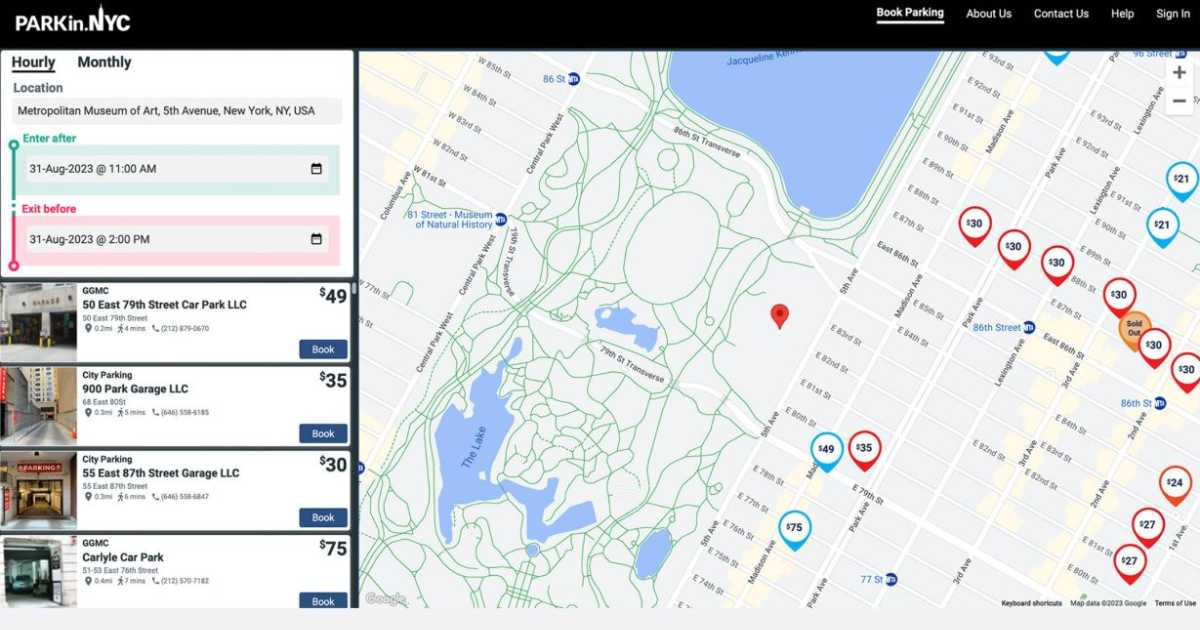

When It Comes To Managing Propertiesí Parking, Technology Is Key

Itís easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because itís mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they havenít figured out how to maximize its value....

January 23, 2025 | 5 min read

Partner Content

Making Visitor Management a Welcome Experience

If youíre in CRE, you already know the challenges of managing and tracking visitor access at your properties....

November 22, 2024 | 3 min read

Partner Content

Shadow IT: The Hidden Threat to Real Estate Companies

In today's rapidly evolving technological landscape, the emergence of Shadow IT poses significant challenges for organizations, particularly in the commercial real estate sector....

November 7, 2024 | 3 min read

Partner Content

How Bridge Investment Group Cut Manual Data Entry and Improved Onsite Productivity

In CRE, efficiency isn't just a goal; it's a necessity for survival. Leveraging technology as a means to cutting through operational drag and optimizing employee productivity has become a competitive imperative for success....

October 31, 2024 | 3 min read

Feature

Updated Enterprise Architecture Overview for Corporate Real Estate and Facilities: Are We Still Treading Water or Making Progress?

Realcomm has released an updated version of its Corporate Real Estate and Facilities Information Management Systems Enterprise Architecture Overview infographic....

October 24, 2024 | 2 min read