CBRS Gives Commercial Real Estate Access to Once-Exclusive Cellular Spectrum

If you could access something highly compelling, yet previously off-limits to all but an exclusive group - such as purchasing pre-IPO shares of the next unicorn company or scoring tickets for the hottest new musical since Hamilton or flying private instead of commercial - you’d jump at the chance, right?

That time is now for owners, operators and tenants who have the opportunity to use carrier-grade cellular frequencies for their building or campus wireless networks. It’s called CBRS, and its significance cannot be overstated.

Until now, cellular frequencies have been within the reach of only those having the deepest pockets to obtain a license. To quantify, we’re talking about investments in the tens of millions, hundreds of millions and even billions. That essentially narrows it down to wireless carriers who use these frequencies for their public networks or Fortune 100 companies who use them for special private networks. But with CBRS, virtually any commercial real estate organization across almost every asset class can leverage carrier-grade cellular frequencies without applying for an FCC license to set up their own wireless network and reap benefits superior to Wi-Fi including performance, security and cost.

So, what are you waiting for?

What is CBRS?

CBRS stands for Citizens Band Radio Service. It’s also referred to as OnGo™.

CBRS is an initiative conceived by the Federal Communications Commission (FCC) to solve for the shortage of frequencies available for wireless communications. In September 2019, CBRS was commercialized following the development of specifications and certifications as well as field trials and market pilots.

What’s unique is CBRS frequencies are shared among stakeholders using a three-tiered hierarchy that prioritizes users in higher tiers and protects them from interference from users in lower tiers. Equally significant, lower tier users don’t require a license per se; by meeting certain requirements identified by the FCC, these users are “lightly-licensed” to use a CBRS frequency band. This approach not only democratizes access to the tranche of spectrum but, more importantly, it is what puts it within economic reach of owners, operators and tenants.

What are the benefits?

CBRS delivers to real estate organizations stand-out performance, security and cost benefits for wireless networks.

First and foremost, CBRS provides considerable capacity and low latency performance which is ideal for mission-critical and business-critical services and applications. Likewise, CBRS enables wireless networks to cover large spaces. In addition, CBRS provides very high quality-of-service (QoS) and mitigates interference. Finally, CBRS ensures smooth handoffs when users and objects move throughout the facility. Collectively, these performance indicators make for a network is that is both highly predictable and reliable.

As a protocol, LTE is inherently secure; Wi-Fi, not so much. CBRS also enables networks to be architected to be private, so data traffic stays inside the building. That means the traffic between devices and servers doesn’t touch the public internet, and vice versa.

Carrier-grade cellular spectrum is within the reach of nearly any organization. Depending on the approach, costs typically consist of monthly core network and access network expenses which comprise the CBRS license, management of the license known as Spectrum Access System (SAS), backhaul, and the radio access network. Costs often are in line with your ISP expenses but with the aforementioned performance and security benefits. In fact, CBRS can be less expensive than Wi-Fi networks to cover larger areas.

What are the key use cases?

CBRS is poised to enable three notable use cases which include: private networks, Internet of Things (IoT) connectivity, and in-building cellular coverage.

You are already familiar with private networks which you’ve likely architected with Wi-Fi to keep data within your facility only. CBRS, however, takes private networks to the next level to support nearly an infinite array of business applications. For instance, CBRS is a better approach for covering large spaces such as a warehouse or data center. CBRS low latency excels in connecting unmanned ground vehicles (UGVs) or assembly line machines in manufacturing plants. Similarly, CBRS high bandwidth is peerless in connecting untethered surveillance cameras. For safeguarding sensitive information in healthcare, research, financial or other corporate facilities, CBRS can’t be beat. Plus, CBRS private networks relieve strained Wi-Fi networks and empowers organizations to be more strategic about wireless network planning and management.

As more and more sensors are deployed to monitor, control, analyze and optimize real estate operations as well as unlock new big data opportunities, IoT connectivity requirements also increase. CBRS is ideal for supporting IoT devices across vast areas and providing secure and uncompromising connectivity that neither requires additional infrastructure nor conflicts with other services on the network. CBRS is, therefore, advantageous compared to public cellular, Wi-Fi or single-purpose specialty networks like Low-Power Wide Area Network (LPWAN) operators.

Finally, although smartphone enablement ranks near the top of the list of priorities for nearly all owners, operators and tenants, many buildings and campuses are left without cellular coverage because wireless carriers won’t provide a signal source for an in-building wireless network. Or it’s too expensive and complicated for IT groups that are already spread thin. CBRS may eventually provide multi-operator cellular connectivity inside buildings by removing the need for a carrier-initiated signal source and making network management more accessible. And because CBRS is based on cellular, there exists an upgrade path to 5G.

What are some industry business cases?

To further connect the dots, here are highlighted business cases various industries are addressing with CBRS wireless networks:

- Factories, warehouses, logistics centers and data centers - uptime reliability, quality assurance, reduced operating costs, operating efficiency, security and theft deterrence

- Hospitals and medical campuses - quality of care, PHI HIPAA compliance, mobility, physician retention, Wi-Fi relief

- Office buildings and campuses - tenant retention, asset monetization, workplace productivity, energy management, BYOD support, access control

- Gaming & casinos - rich data analytics, guest experience, improved communications and security

- Schools and campuses - attract students and faculty, reduce digital divide, digital record keeping, campus safety

- Hotels and Resorts - guest experience, data analytics, reduced safety- and business-critical services costs, information privacy integrity

- Retail stores and malls - attract customers, enhanced consumer experience, reduced connectivity infrastructure expense and complexity, security

This Week’s Sponsor

Intelligent Buildings begin with Intelligent Wireless Connectivity. RF Connect ensures business-critical applications, BYOD initiatives, occupant connectivity and public-safety communications requirements are met. We do this by designing, deploying, managing and operating wireless communication networks indoors and outdoors. Our scope encompasses technology solutions, capital funding, and turnkey managed services to address the wireless imperative for today and the future. www.rfconnect.com

Read Next

3/27/2025

3/27/2025

The Convergence of Edge Computing, Cloud, and AI in Building Automation and Smart Buildings In the built environment, we have seen the convergence of Operational Technology (OT) and Information Technology (IT), later expanding to include Workplace Technologies (WP).

3/27/2025

3/27/2025

DC Power: A Holistic Approach to Energy Savings in Commercial Buildings In today's energy-conscious world, businesses constantly seek ways to reduce their carbon footprint and operational costs.

3/13/2025

3/13/2025

How to Achieve Eco-Friendly Facility Management Commercial real estate operators and facility managers are focusing on sustainable practices to minimize environmental impact, create healthier workplaces, improve productivity and lower operational costs.

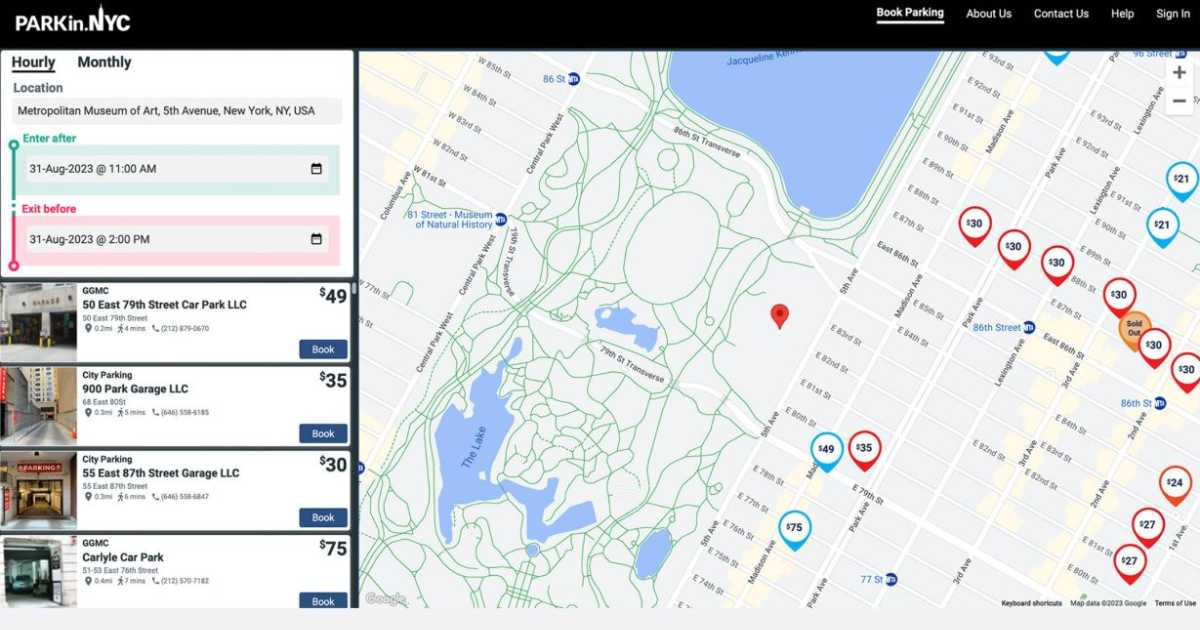

1/23/2025

1/23/2025

When It Comes To Managing Properties’ Parking, Technology Is Key It’s easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because it’s mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they haven’t figured out how to maximize its value.

.gif)