Creating Pathways to Higher ESG Scores

What does an ESG rating do for your real estate business? A good ESG rating means a company is managing its Environmental, Social and Governance risks well relative to its peers. It also promotes stronger relationships with clients and investors. And with a high ESG score, it’s easier to raise capital.

According to the Harvard Law School Forum on Corporate Governance, “A 2020 survey by SustainAbility found that ESG ratings are the most frequently referenced source of information that institutional investors rely on to gauge ESG performance (55 percent, tied with direct company engagement). Another survey found that 88 percent of investment professionals use third-party ESG ratings as a part of their investment process, with 92 percent expecting to do so in the future. The importance of ESG ratings to the asset management business is demonstrated by the flow of funds into ESG-labeled investment products.”

When it comes to ESG scores, the energy consumption of properties is critical and where there are high carbon emissions through energy usage, companies need to take action to reduce them. It’s also important to consider how efficiently equipment is working and where it should be upgraded for sustainability gains. Attention must also be paid to tenant comfort and the healthiness of building environments. Investors are looking at the overall value of buildings, including the impact that companies and their assets have on local communities.

How are you tracking the impact of your buildings, and where can you optimize performance to raise your ESG score and increase asset value? For starters, you can improve your overall ESG strategy by evaluating long-term trends.

Benchmarking, Reporting & Certification

Portfolio-level benchmarking, tracking and reporting help you identify and prioritize the most significant energy savings opportunities. By measuring the long-term impact of building-specific energy projects, you can also calculate payback periods and justify future efficiency projects. For example, real-time data from a building automation system (BAS) controlling your HVAC can often create a business case for more advanced building performance applications, such as fault detection and diagnostics or active optimization using artificial intelligence for continuous commissioning. You can easily evaluate long-term trends at the building or portfolio level and push reports to all executives and other audiences, enhancing visibility for all stakeholders.

Certification by an independent third-party organization is another way to increase visibility of properties that demonstrate high efficiency and low GHG emissions. Organizations such as ENERGY STAR®, LEED® and GRESB® score and accredit buildings. Many compliance programs accept certification from these entities as proof that buildings have achieved energy and water efficiency and low greenhouse gas (GHG) emissions. Advisory and consulting firms staffed with accredited professionals can help property owners and managers apply for these certifications.

Energy Auditing

Your energy information system (EIS) or technology platform can help ensure that you are collecting accurate data. One of the primary ways for collecting real-time data is through pulse-enabled smart utility meters, which send frequent pulses that correlate to a defined amount of energy consumption. Your existing meters may already have pulse outputs in place; if not, your utility provider can install compatible meters. Once meters are installed, your EIS vendor can configure a data logger to collect data from the pulse output and push it to the cloud.

In addition to consumption data analysis, a physical survey of the property will identify opportunities to improve efficiency. These surveys can range from simple, walk-through “treasure hunts” to extensive reviews of recommended solutions. In addition to identifying CAPEX improvements that perform financially, low- and no-cost solutions are identified for immediate savings. As with building certifications, firms staffed with accredited professionals can help property owners and managers survey properties and report on their findings, analysis and recommendations.

Operational Strategies

Technology can be applied to building management very effectively, as most operators and asset managers already know. For example, artificial intelligence can be used to maximize tenant comfort and energy efficiency. Smart energy software can manage the empty spaces in a building, turn off lights left on by accident or even set limits on how high or low tenants can adjust the thermostats. Today’s tenants generally expect motion-sensor lights and low-flow water systems in addition to centrally controlled thermostats. Savvy investors take this further and want more efficient equipment such as air handling units, given their deeper understanding of the impact of buildings on the environment.

When it comes to ESG, everyone struggles to get whole-building data. Technology can be leveraged to provide aggregated whole-building data and companies can use that data to enhance operational efficiency. Real-time data gives you visibility over the energy consumption in your building, which then allows you to decide what to change to improve performance. Even after that, you can see what those changes have done for your sustainability goals, which can prevent you from sliding back and help you make further improvements that will continuously drive higher ESG scores for your properties.

This Week’s Sponsor

Yardi® develops and supports industry-leading investment and property management software for all types and sizes of real estate companies. Established in 1984, Yardi is based in Santa Barbara, Calif., and serves clients worldwide. For more information on how Yardi is Energized for Tomorrow, visit yardi.com.

Read Next

3/27/2025

3/27/2025

The Convergence of Edge Computing, Cloud, and AI in Building Automation and Smart Buildings In the built environment, we have seen the convergence of Operational Technology (OT) and Information Technology (IT), later expanding to include Workplace Technologies (WP).

3/27/2025

3/27/2025

DC Power: A Holistic Approach to Energy Savings in Commercial Buildings In today's energy-conscious world, businesses constantly seek ways to reduce their carbon footprint and operational costs.

3/13/2025

3/13/2025

How to Achieve Eco-Friendly Facility Management Commercial real estate operators and facility managers are focusing on sustainable practices to minimize environmental impact, create healthier workplaces, improve productivity and lower operational costs.

1/23/2025

1/23/2025

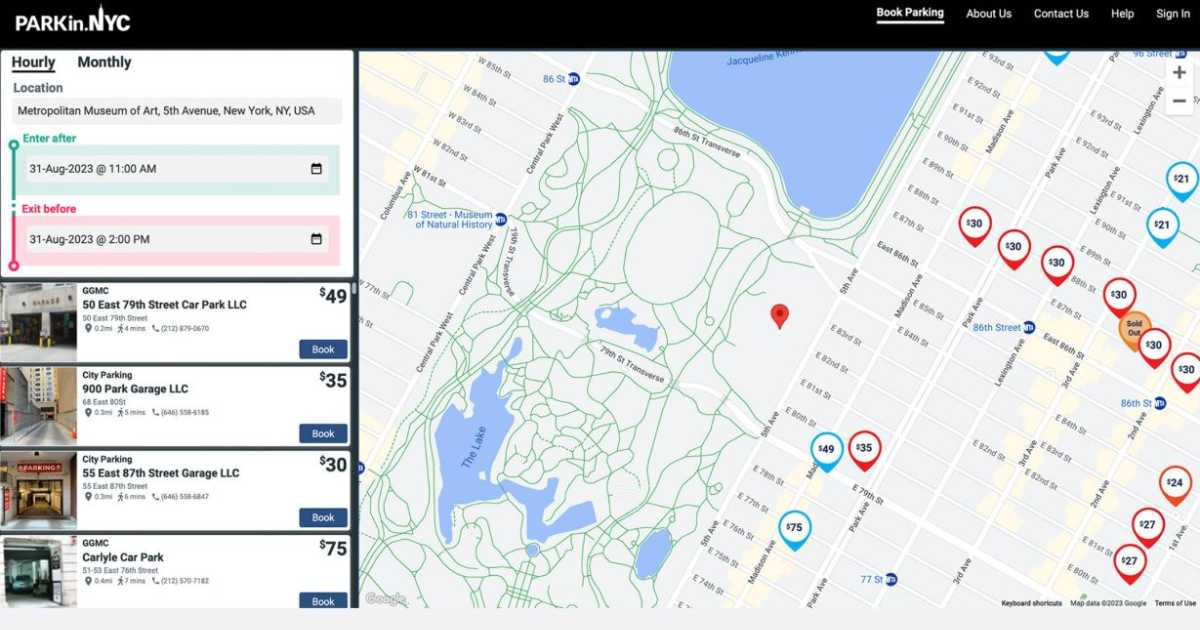

When It Comes To Managing Properties’ Parking, Technology Is Key It’s easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because it’s mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they haven’t figured out how to maximize its value.

.gif)