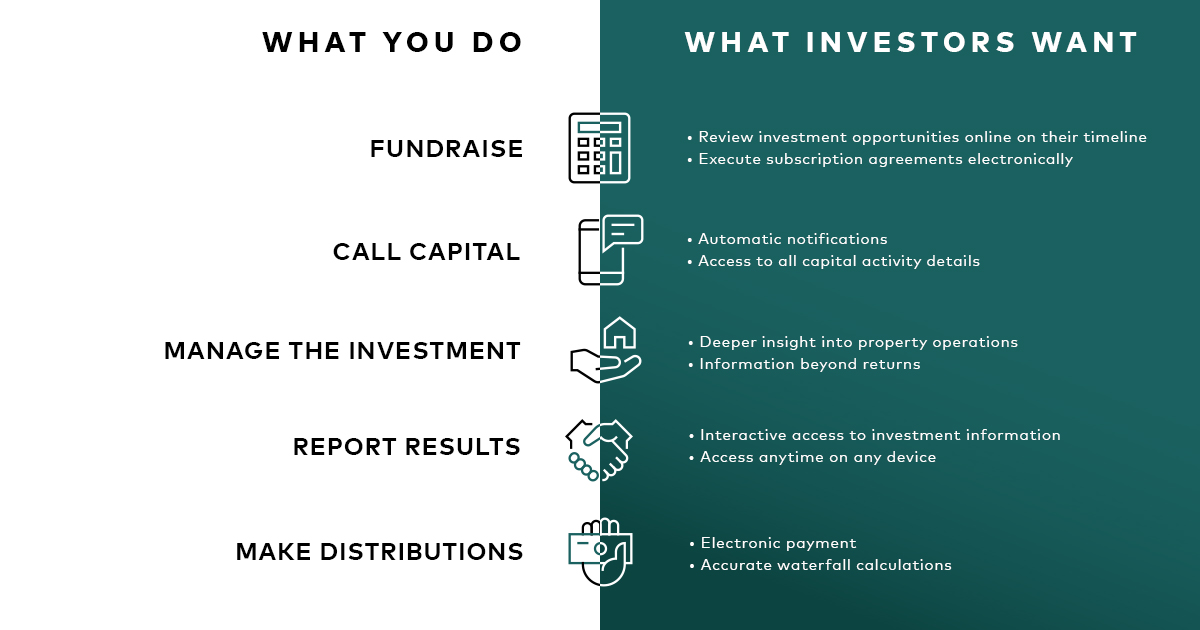

What Do Real Estate Investors Really Want?

People invest in real estate with the expectation of making a return on their investment through periodic distributions and increased asset value. Although that fact remains largely unchanged over time, some elements of the investment process are evolving, most notably investor expectations for timely access to information.

Ownership vehicles for real estate investments include partnerships, closed end and open-ended funds, REITs and more. Regardless of the myriad of complex structures, tax considerations and rules that apply to any particular investment vehicle, investors’ priorities remain constant: optimized returns, timely capital solicitations and communication across the investment lifecycle, and accurate determination of distributions.

Evolving expectations

The changes in investor expectations over the past several years stem from technological advances. Many real estate investment organizations continue to issue paper reports and capital calls to investors by email or regular mail, pay distributions with paper checks, go back and forth in email to complete the subscription agreement process and utilize spreadsheets to calculate returns and distributions.

These methods clash with the online and remote convenience real estate investors experience with other assets and technology they use in their daily lives. Investors expect the same real estate investment information to be accessible when and where they want it. The days of reports with stale data are coming to an end.

What’s more, current and prospective investors are more closely following the operational aspects of their real estate investments and how those assets will be enhanced in terms of value and income production. Those aspects include a property’s day-to-day operational elements such as rental income, leasing activity, marketing and capital improvements. Whereas investor reporting previously was primarily confined to financial performance. Knowing that property operations affect cash flow and ultimately give rise to distributions and higher asset value. Today’s investors want not only the numbers but what’s driving them.

Tech shapes expectations

This realization has prompted many investment managers to adopt technology platforms capable of delivering approved information in near real time, no matter the complexity of the investment structure and its elements.

A single connected technology platform for investment management draws information from one source of the truth. Such a platform gives investment managers and investors alike clarity into their holdings, helps identify risks and provides full transparency from an investor to asset operations.

The single platform approach also eliminates the risk of losing data transferred between disparate systems or manually maintained in spreadsheets.

Multifaceted benefits

A single connected technology platform enables analysis of investor, investment and asset key metrics, effective communication with investors and efficient management of the subscription agreement process. Investors can know that their partners are leveraging a comprehensive technology platform to manage all aspects of the investment lifecycle. That, in turn, assures investors that risks are being minimized and the information they see is timely and accurate.

Satisfying tech-savvy, increasingly sophisticated and inquisitive investors requires mitigating risks, optimizing returns and value and making information available when it’s needed. Yardi® Investment Manager, part of the Yardi® Investment Suite, can help investment managers increase investor confidence, reduce costs and enhance efficiency. Yardi Investment Manager can serve as a standalone solution or with Yardi Voyager® or Yardi Breeze Premier.

This Week’s Sponsor

Yardi® develops and supports industry-leading investment and property management software for all types and sizes of real estate companies. Established in 1984, Yardi is based in Santa Barbara, Calif., and serves clients worldwide. For more information on how Yardi is Energized for Tomorrow, visit yardi.com.

Read Next

3/27/2025

3/27/2025

The Convergence of Edge Computing, Cloud, and AI in Building Automation and Smart Buildings In the built environment, we have seen the convergence of Operational Technology (OT) and Information Technology (IT), later expanding to include Workplace Technologies (WP).

3/27/2025

3/27/2025

DC Power: A Holistic Approach to Energy Savings in Commercial Buildings In today's energy-conscious world, businesses constantly seek ways to reduce their carbon footprint and operational costs.

3/13/2025

3/13/2025

How to Achieve Eco-Friendly Facility Management Commercial real estate operators and facility managers are focusing on sustainable practices to minimize environmental impact, create healthier workplaces, improve productivity and lower operational costs.

1/23/2025

1/23/2025

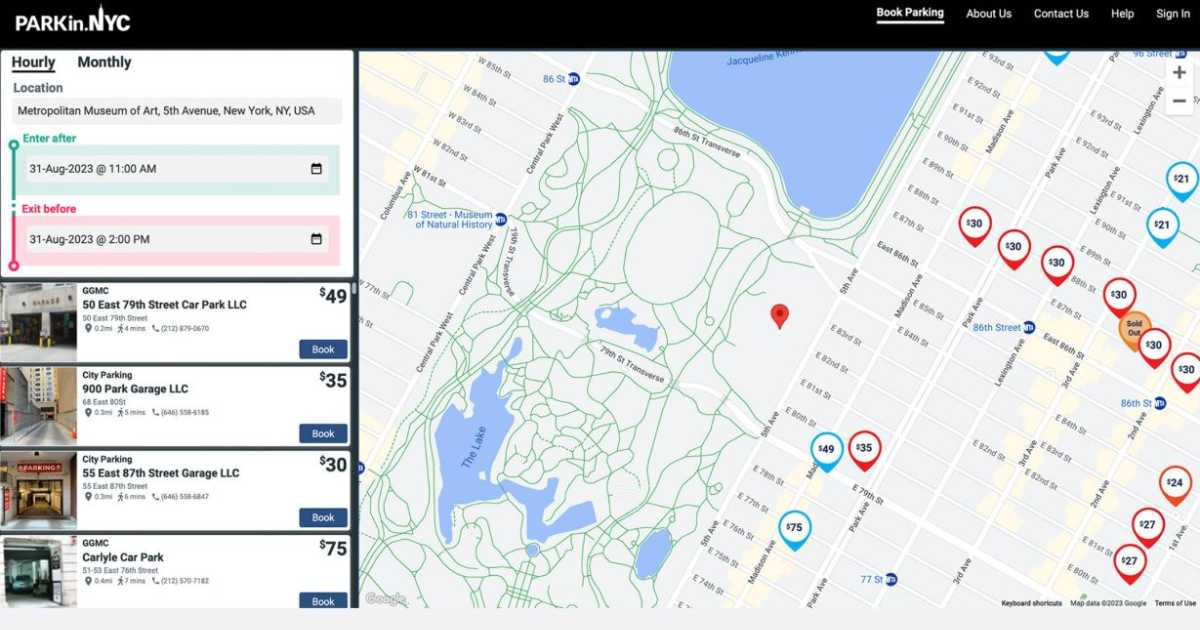

When It Comes To Managing Properties’ Parking, Technology Is Key It’s easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because it’s mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they haven’t figured out how to maximize its value.

.gif)