5 Corporate Real Estate Investments to Boost Your Cash Flow

Despite the dramatic changes we’ve seen over the past year, there will always be a need for real estate.

As the world begins to slowly reopen, we’ll need spaces to live, work, and gather as part of a community. The question real estate investors are asking is, what will those spaces be?

Here are five types of buildings and technology that make excellent corporate real estate investment opportunities.

Coworking spaces

When coworking spaces began rising in popularity in the early 2000s, the occupants were mainly startups, small business owners, and freelancers. While these location-independent professionals and companies still account for the majority of coworking space tenants, even before the onset of the pandemic, the percentage of corporate employees also using coworking spaces was increasing.

Now, as a result of the pandemic, the demand for coworking spaces by gig workers and larger organizations is only going to grow, making these properties an excellent corporate real estate investment opportunity.

As employers begin welcoming employees back into the office, many business leaders expect to have a hybrid workplace in which employees spend some days in the office and some days working remotely. Nearly three-fourths of employers anticipate that a significant number of their employees will work offsite at least one day a week, according to the September 2020 update of CBRE’s 2020 Global Occupier Sentiment Survey.

Another factor contributing to the rise in coworking spaces is that more professionals are taking advantage of opportunities created by the gig economy. A study by Upwork, a freelancing job platform, found that 59 million Americans are now freelancing. This is 36% of the total U.S. workforce, and many of them will likely be using coworking spaces as their home base.

Fulfillment and distribution centers

Unsurprisingly, online shopping rose dramatically in 2020, with U.S. ecommerce recording a 44% year-over-year increase in sales. And although the increase may not be this dramatic in the coming years, the shift to online purchases over in-person shopping is likely to be more permanent.

This change in buying habits, coupled with consumer expectations regarding lightning-fast shipping speeds (known as the “Amazon effect”), means retailers will need to occupy several fulfillment and distribution centers across multiple locations to stay competitive. They may also have to increase the volume of products they keep in stock, further amplifying their corporate real estate requirements.

As a result, industrial real estate has seen a surge in demand. CBRE research estimates warehouse space demand will reach 250 million square feet this year, an 18% increase over the previous five-year annual average. CRE executives in search of commercial property should consider warehouses and distribution centers as a way to improve their cash flow.

Micro-units

Micro-units are commercial or residential spaces that have a total square footage well below the market average, usually under 500 square feet. They have historically been used for multifamily residential properties (particularly in high-density metropolitan cities like San Francisco, Chicago, and New York) but have recently started to spread to commercial settings.

Micro-offices represent a great corporate real estate investment opportunity because they provide flexibility to both property owners and occupants. Owners can charge higher rates per square foot while offering lessees an alternative to traditional office spaces that costs less and is closer in size to what they actually need.

Property owners can fit more tenants into their buildings and create additional sources of income, which mitigates the impact of late payments.

Micro-units are also more accessible to a wider range of tenants because they have shorter and more flexible lease terms than a conventional office building. That means property owners can lease these rental properties to startups and entrepreneurs who aren’t able to commit to a long-term agreement or who don’t need several thousand square feet of space.

Adaptive reuse

Adaptive reuse refers to the practice of modifying existing real estate for a use other than the purpose for which it was originally built. The goal of adaptive reuse is to convert underutilized or unused properties into real estate that better serves the current market. It also prevents building demolition and new construction to reduce waste and support sustainability.

In the wake of COVID-19, where thousands of businesses were forced to close their doors, adaptive reuse can be an effective strategy for breathing new life into real estate that may otherwise sit vacant.

Applying adaptive reuse to retail space, event venues, and hotels may be a better corporate real estate investment opportunity than waiting for another business in the same sector to be interested in renting an unoccupied space.

For example, converting a hotel into an affordable multifamily property or turning a large retail location into a fulfillment and distribution center can yield a substantial return since affordable housing and industrial real estate are in such high demand.

PropTech

As you consider where to invest resources and capital in the near future, don’t focus exclusively on the properties themselves. You should also identify potential corporate real estate investments that make it easier to manage those properties.

PropTech refers to solutions and technologies that simplify, streamline, and modernize all aspects of corporate real estate. The goal of PropTech is to empower CRE executives with robust tools and technologies to optimize the planning, financing, construction, marketing, leasing, and management of every property in their portfolio.

One example of PropTech is the Internet of Things (IoT) sensors, which enable CRE leaders to have real-time visibility into the conditions of indoor environments, such as temperature, humidity, and occupancy. This live data gives CRE executives the insight they need to keep building occupants safe.

Another valuable PropTech solution is a real estate management platform. This allows you to track and analyze occupancy, utilization, and performance for all your properties. You can build custom dashboards and reports with these details and use this information to optimize your real estate portfolio.

Manage all your corporate real estate investments in one place

While the COVID-19 pandemic undoubtedly affected the corporate real estate industry as a whole, not all sectors were impacted equally. Certain sectors and property types are thriving as consumers have changed their habits and behaviors in response to the pandemic.

While no one can say for certain how the recovery from the pandemic will impact the future corporate real estate market, you can spot trends sooner with the right data at your fingertips.

iOFFICE’s cloud-based software digitizes all your property data and floor plans so you can see and interact with all your portfolio assets, anytime.

You can quickly identify underutilized properties and develop a plan to address them – whether that means subleasing, redesigning, consolidating, or selling. You can easily plan and manage large building moves with drag-and-drop functionality. And you can set up customized dashboards to track the real estate metrics that matter most to you.

This Week’s Sponsor

iOFFICE | Corporate Real Estate Management For A Changing Landscape: The future of real estate management belongs to corporate real estate leaders who are flexible. But you can only seize these opportunities if you have full visibility into how occupants are using your spaces - and how your game plan impacts your portfolio. www.iofficecorp.com

Read Next

3/27/2025

3/27/2025

The Convergence of Edge Computing, Cloud, and AI in Building Automation and Smart Buildings In the built environment, we have seen the convergence of Operational Technology (OT) and Information Technology (IT), later expanding to include Workplace Technologies (WP).

3/27/2025

3/27/2025

DC Power: A Holistic Approach to Energy Savings in Commercial Buildings In today's energy-conscious world, businesses constantly seek ways to reduce their carbon footprint and operational costs.

3/13/2025

3/13/2025

How to Achieve Eco-Friendly Facility Management Commercial real estate operators and facility managers are focusing on sustainable practices to minimize environmental impact, create healthier workplaces, improve productivity and lower operational costs.

1/23/2025

1/23/2025

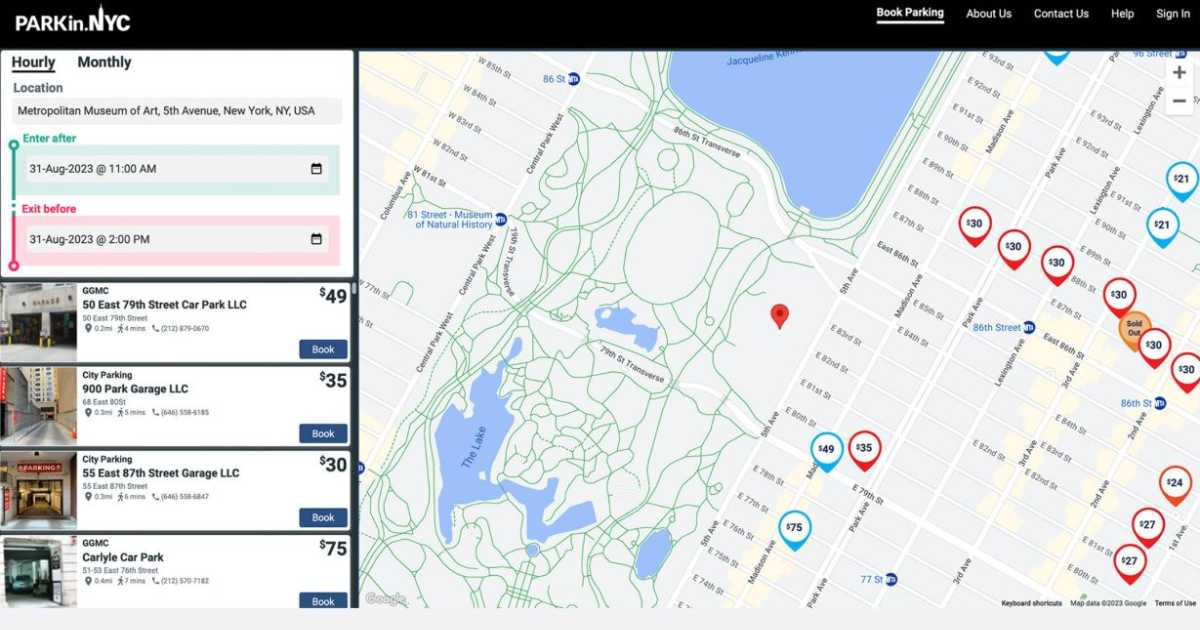

When It Comes To Managing Properties’ Parking, Technology Is Key It’s easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because it’s mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they haven’t figured out how to maximize its value.

.gif)