The 'Now Normal' vs. the New Normal for Commercial Real Estate: What Changes Are Going to Stick?

As we look ahead to next year, now is the time to reflect on the twists and turns of 2020 and consider how to best plan for the future. We’ve written previously about using technology to facilitate forecasting during a period of high uncertainty, and we wanted to take it a step further by asking some industry leaders for their opinion. With that in mind, we took the opportunity to speak directly with such experts during our annual users conference, MRI Ascend, which was held online in late October 2020.

Two of our virtual panels featured clients and partners with expertise in the office and retail arenas. “The Future of the Office” included Scott Morey, executive director of One11 Advisors, a real estate management consulting firm; Tim Curran, CEO of Building Engines, a provider of building operations software; and Robert Pavese, partner at Atlanta Property Group, an owner and operator of office buildings.

The retail panel focused on operational challenges, with panelists Melina Cordero, managing director of CBRE; David Jamieson, executive VP and COO of Kimco, and Jennifer Holmes, chief accounting officer of Urban Edge.

Let’s look at some key takeaways from our conversations with these experts that should inform forecasting for office and retail owners and property managers.

Office

For commercial office buildings, the pandemic has shifted tenant demand from amenities - e.g., on-site gyms, yoga classes, and ping-pong tables - to safety and security. Tenants today, not surprisingly, are more concerned about sanitation measures and air filtration. To address these concerns, owners and operators should provide regular cleaning services to sanitize the office, install appropriate ventilation systems, and control overcrowding in lobbies through effective visitor management systems.

Furthermore, the panelists noted that transparency is essential: It’s not sufficient to take these steps; owners and operators have to relay them to tenants through a variety of communications such as apps, texts, and emails, each of which is preferred by different demographics. Members of Gen Y, for example, are avid texters. Whatever the format, owners and operators should err on the side of frequency; tenants who are reassured that their buildings are safe will be more inclined to return to the office.

So what will stick in the long run? Tenants will likely pay more attention to indoor air quality and ventilation in the future because they’ll be more knowledgeable about virus transmission. But once the pandemic subsides, they’ll develop a renewed interest in amenities. Demand for both will become more balanced than it is today.

The panelists also addressed the effects of remote working on space planning. They believe that we’ll see a combination of on-site and remote working in the future, but it will depend on the industry. Remote working is fine for some sectors, but others require face-to-face collaboration.

While remote working is gaining ground, so is the need for expanded office footprints, given the need for social distancing. The result is a direct contradiction to the popular “cubeland” office layouts designed for increased density. On the other hand, if more people work remotely, there will be more room per person onsite. It’s possible, therefore, that requirements for square footage may not change drastically, but tenants and landlords should keep an eye on changes in market value per square foot.

It’s clear in any case that tenants are now prioritizing flexibility. Some owners were already adapting forms of co-working models in-house before COVID hit, as mentioned in the recent Verdantix report. These models allowed tenants to avoid long lease commitments and adjust their space needs according to growth or contraction. Post-COVID, such demand for flexibility is likely to continue.

Retail

For the retail sector, our panelists agreed that certain trends that accelerated during the pandemic will extend into the post-pandemic market. Curbside delivery is one example. Customers like having many options, one of which is buying online and picking up at the store. That won’t change. Retailers likewise benefit from curbside delivery because it saves money on shipping costs.

Another consideration is the growth of outdoor dining, which is adding to the appeal of “open air” occupancy. Consequently, retailers are demonstrating increased interest in strip malls as opposed to indoor malls.

One trend that preceded the pandemic was the emphasis on the in-store experience. Because of the pandemic, the focus has shifted to safety, bringing contactless purchasing to the fore. Even after the pandemic has passed, contactless purchasing will continue to gain momentum. Yes, it’s safer, but it’s also more efficient: The technology enables customers to avoid waiting in lines, which, in turn, increases customer satisfaction.

As for space requirements, the panelists noted two developments: 1) optimization of space and smaller footprints for some stores, and 2) the need for more storage space for last-mile distribution. Therefore, we see a similar scenario to that of office: Some consumer trends are reducing the need for space while others are raising them. It doesn’t seem too much of a stretch, then, to suggest that in light of these contradictory developments, net change in space requirements post-COVID might just be negligible.

What’s ahead

Combine the predictions of experts like the ones who participated in MRI Ascend with technological advances in budgeting and forecasting, and you can make informed decisions on what to expect in office and retail leasing in the upcoming months and years. You can start distinguishing between the now normal and the new normal. If the past year has taught us anything, it’s that the ability to adapt is the only way to survive. You can start preparing but be sure to leverage technology to stay flexible.

This Week’s Sponsor

MRI Software delivers innovative applications and hosted solutions for real estate owners, operators, occupiers, and investors. Through a flexible technology platform and an open and connected ecosystem, MRI meets the unique needs of real estate businesses – from property-level management and accounting to investment modeling and analytics for the global commercial and residential markets. For more information, please visit www.mrisoftware.com.

Read Next

3/27/2025

3/27/2025

The Convergence of Edge Computing, Cloud, and AI in Building Automation and Smart Buildings In the built environment, we have seen the convergence of Operational Technology (OT) and Information Technology (IT), later expanding to include Workplace Technologies (WP).

3/27/2025

3/27/2025

DC Power: A Holistic Approach to Energy Savings in Commercial Buildings In today's energy-conscious world, businesses constantly seek ways to reduce their carbon footprint and operational costs.

3/13/2025

3/13/2025

How to Achieve Eco-Friendly Facility Management Commercial real estate operators and facility managers are focusing on sustainable practices to minimize environmental impact, create healthier workplaces, improve productivity and lower operational costs.

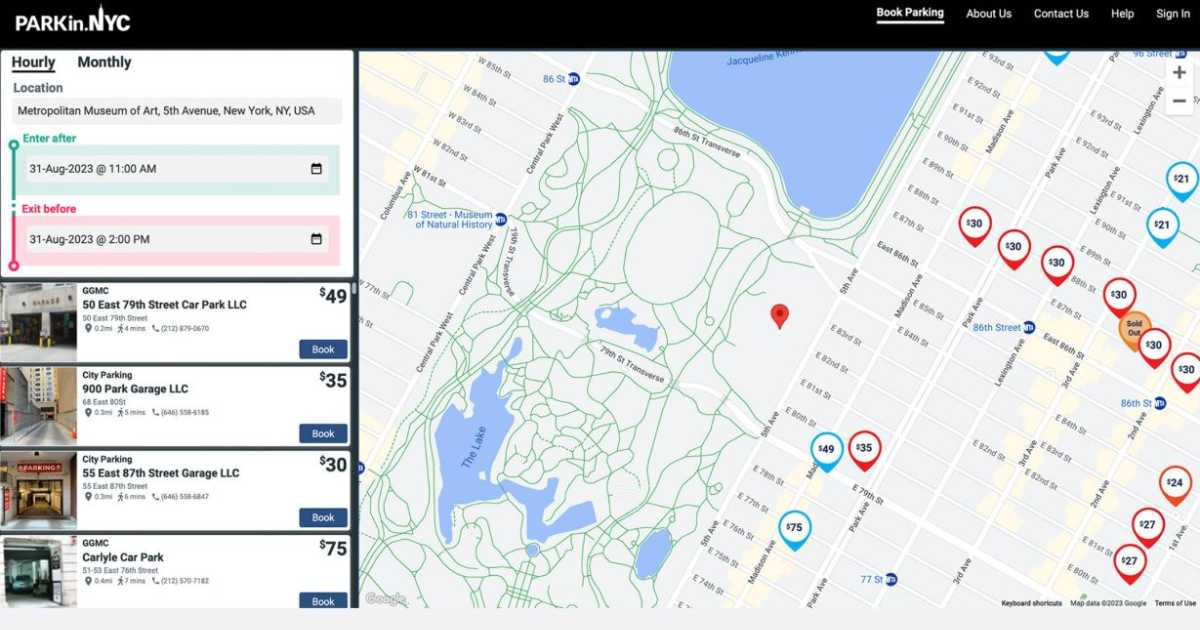

1/23/2025

1/23/2025

When It Comes To Managing Properties’ Parking, Technology Is Key It’s easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because it’s mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they haven’t figured out how to maximize its value.

.gif)