5G: Don’t Wait. A Future-Ready Approach for Building Owners

We’ve all been mulling the meaning of 5G and the move to it. While gathering my thoughts about the what, when, why, and how of 5G in the indoor market, I was trying to put my finger on what smelled different about 5G compared to the more obvious transition movement from 3G to LTE.

At the same time, I read a fantastic post by Ed Gubbins, Principal Analyst at GlobalData, titled, "We’re Not Entering the 5G Era; This Is the Age of 4G/5G." In this post, Ed aptly describes the landscape we see emerging in front of us.

Two excerpts speak to the situation very clearly (emphasis added by author):

“In fact, as 5G hype pervades the public consciousness, it may be useful in sparking discussions between enterprises and operators (or RAN vendors) that lead to LTE investments, because in many cases, the operator will tell the enterprise that what they want from 5G can be accomplished with LTE, only sooner (and perhaps cheaper).”

“Going forward, operators are likely to talk less and less about 4G as they try to stir public demand for 5G. But 4G will remain a silent, steady workhorse, enabling the industry to achieve many of its 5G ambitions.”

So, why is this important? In talking with a number of pretty smart people in the industry, it looks like many real estate decision makers are waiting for 5G infrastructure availability before investing in major cellular service improvements. While that wait occurs, exasperated tenants in poorly served buildings may depart, and potential tenants may say “No bars, no thank you.”

The wait for 5G could be long due to a number of factors:

- The cellular macro-networks (outdoors) are always rolled out first. This rollout takes years to cover a country the size of the US.

- Indoor infrastructure for CRE and enterprises (especially for non-flagship properties and venues) tends to be addressed after the majority of the macro-network rollout is complete.

- There is a lack of clarity, at this time, as to what indoor 5G looks like and its incremental cost above LTE. Oh yes and multiply that by the four major US mobile operators.

- 5G handsets need to replace existing handsets. Gartner reports that average enterprise handset life is 2.5 years. This translates into 2.8% of handsets refreshed every month until 100% turnover in about 30 months.

When taking the position that LTE has a good long life in parallel to 5G and implementing LTE to satisfy the demands of today makes sense, we should consider what we can do to be future-ready with the level of information we have available today. Future-ready is a simple way to state “make the infrastructure investments in a forward-leaning direction such that they may have value in a 5G transition.” The term future-proof does not apply in this situation, as it’s an implied guarantee that the whole investment will carry over.

POTENTIAL SHAPE OF A FUTURE-READY APPROACH

Starting at the bottom of the technology stack, we know that 5G infrastructure will be based on optical transport. In the vertical telecom riser, optical infrastructure has been the sole solution since the 90s, so there is nothing new to consider. In greenfield construction, don’t be shy about installing riser cabling that has massive fiber counts, because the construction costs to remediate an undersized cable plant later will hurt. And, when 1,728 fibers come in a 1-inch-diameter package, there are no space issues.

“This unknown wait time combined with the huge LTE demand pressure for coverage and capacity by enterprise subscribers translates to (1) Don’t wait for 5G, and (2) Don’t wait to invest in your wireless fourth utility.”

Horizontally, we do have a technology shift from copper to fiber. At the targeted data rates that will be delivered to 5G devices, a 5G indoor cell will easily require optical transport. Beyond data rates, the other 5G driver that creates system capacity is densification. This is an engineering way to say there are many smaller cells. The benefit is the devices perform better on smaller cells because there are less devices contending for each cell’s finite resources. Densification implies that estimated coverage areas have to be assumed during design and cabling installed in the overhead plenum to feed them. As recommended for the risers, installing higher fiber counts is recommended. Additionally, to power a coverage area’s network infrastructure, use composite cabling that has copper conductors for power along with the optical fibers for network traffic. This strategy reduces implementation costs and long-term operations expenses by centralizing all the floor’s horizontal infrastructure power and network to its IDF closet(s).

Now, that we have an approach to future-ready cabling, let’s explore the attached active electronic infrastructure. For the majority of buildings today, there is a desire to support two or more mobile operators. The two major US operators are important to enterprises due to their network coverage and focus on the enterprise market. Depending on building size, there are multiple options to deliver signal, but let’s assume that we want to make a DAS decision for a building. What does future-ready look like?

First, we have multiple generations in the DAS market competing against each other, and many may not be future- ready. To simplify the discussion, let’s compare this to cars. Let’s say BMW was still building 2009 models today, along with 2019 models, and you were a buyer. Would you really buy a 2009 model if you had a 2019 option available? This is the state of the available DAS solutions; ranging from coax cables with very lengthy hand-crafted installations to software driven modular optical platforms that are driven by software and keyboards. The 2019 DAS model is going to be far more future-ready than the 2009 model.

Why?

The 5G concepts of mmWave, 5G-NSA, and densification were influencing factors of the architectures during their design. For example, the 2019 DAS system designers knew the first wave of 5G in the US, called 5G-NSA, uses installed LTE for control and sends user data over 5G. At this time, the 5G spectrum is in very high frequencies called millimeter wave or mmWave in 24 Ghz and higher spectrum. The deployment of densified LTE cells complements the short ranges of 5G mmWave signals as the first 5G radios will be adjacent to the existing LTE cells.

“When evaluating DAS today, to be future-ready, you should expect that 5G-NR re-farming will happen and ask your candidate vendor for test results from their labs.”

The other emergent factor that favors 2019 DAS designs is that within their useful life, it is possible that they will experience spectrum re-farming. Re-farming means that the LTE signal source on DAS headend will be replaced with a 5G signal source. At Corning Israel, our teams have already tested and successfully passed 5G-NR over our optical DAS. When evaluating DAS today, to be future-ready, you should expect that 5G-NR re-farming will happen and ask your candidate vendor for test results from their labs.

Finally, to circle back on the opening and “The Age of 4G/5G,” many enterprises may be suited to operate on LTE long term and will not require the additional 5G features. This does not mean that LTE won’t be replaced by 5G eventually, what it does mean is that the convergence onto a single network will happen more slowly because LTE is not collapsing under the load like 3G was when smartphones emerged. LTE will quietly co-exist alongside 5G and support our needs for some time into the future.

The message is clear: Don’t wait.

This article is reprinted with permission from Connected Real Estate Magazine.

This Week’s Sponsor

Angus Systems is a leading provider of customer driven mobile and cloud-based work order and operations management solutions for commercial real estate. Our software supports over 2 billion square feet across North America in buildings from 20,000 to portfolios of more than 100 million square feet. Visit www.angus-systems.com to learn how we help our clients shine.

Read Next

3/27/2025

3/27/2025

The Convergence of Edge Computing, Cloud, and AI in Building Automation and Smart Buildings In the built environment, we have seen the convergence of Operational Technology (OT) and Information Technology (IT), later expanding to include Workplace Technologies (WP).

3/27/2025

3/27/2025

DC Power: A Holistic Approach to Energy Savings in Commercial Buildings In today's energy-conscious world, businesses constantly seek ways to reduce their carbon footprint and operational costs.

3/13/2025

3/13/2025

How to Achieve Eco-Friendly Facility Management Commercial real estate operators and facility managers are focusing on sustainable practices to minimize environmental impact, create healthier workplaces, improve productivity and lower operational costs.

1/23/2025

1/23/2025

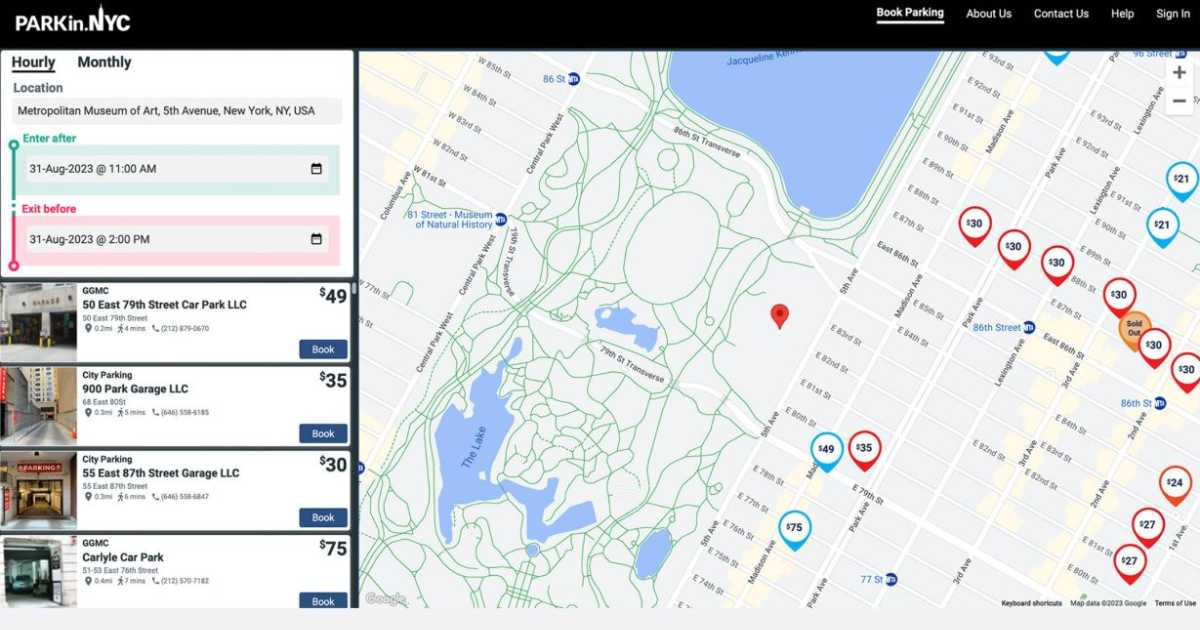

When It Comes To Managing Properties’ Parking, Technology Is Key It’s easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because it’s mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they haven’t figured out how to maximize its value.

.gif)