Connected Planning and Its Impact on Commercial Real Estate

The U.S. Census Bureau recently released its retail and food services report for February. It highlighted, among other trends, that online sales gained a slight edge over brick-and-mortar stores (11.813% versus 11.807%)—one of many major milestones that represent the scope and scale of online shopping growth. The ongoing shift in consumer behavior toward the convenience of online shopping impacts the wider commercial real estate industry. For example, this shift in consumer trends affects how specialty leases are structured in shopping centers, how flexible office space is weighted compared to traditional tenancies, and how investments are made with regard to warehousing demands.

To define, achieve, and sustain success, commercial real estate businesses need to approach how they balance portfolios differently than in the past, starting with a more holistic view of the entire supply and demand model across the omnichannel. This goes from unit level budgeting and forecasting, through sector and geographic portfolio analysis, to corporate enterprise value, EPS and complex allocations. For fund managers, it includes both a ‘bottom-up’ aggregation of property forecasts to the Fund level, as well as more strategic ‘top-down’ drive-based scenario modeling and stress testing. To achieve this, many real estate businesses are looking to Connected Planning technology for more valuable insight and better decision-making.

What Connected Planning offers the Commercial and Investment Real Estate Industry

In commercial and investment real estate, the trends of the past have already impacted business in the future. Institutional and personal investors are demanding more granular detail around their investments, and faster reporting turnaround with transparent calculations is quickly becoming the industry standard. This means that stand-alone point solutions, 'black box' calculations with no transparency, complex tools that require specialized scripting, or custom spreadsheets with 'key man' risk in the information chain no longer suffice.

Controlling today and preparing for the future can be enabled by adopting an enterprise Connected Planning approach. In recent years there has been a shift of focus from back office accounting and reporting systems to more disruptive Enterprise Planning platforms. Gartner has been covering the Cloud Financial Planning and Analysis sector for the past five-plus years and is a great source of information for which platforms address which parts of the enterprise planning value chain. These platforms have been embraced by numerous REITs and asset/ investment managers to complement their historic and financial reporting with powerful, forward-looking analytics from the granular lease level up to corporate or fund level forecasts.

With Connected Planning platforms, commercial real estate businesses can plan continuously and make decisions in real time. Their cloud architecture eases collaboration across the enterprise to streamline the planning process. What’s more, some platforms also leverage the input of artificial intelligence and machine learning technologies to facilitate rapid, ongoing planning while factoring in signals and drivers from both inside and outside the company.

How the Platform Benefits Commercial Real Estate Companies

Market conditions continue to change at an increasing rate—showing no signs of stopping. For the commercial real estate industry, business leaders need to consider and plan for those changes in order to maintain positive cash flow, increase margins, make the most informed decisions, and report out quickly. This could be as simple as deciding if a below market lease is the best longer-term decision for an asset to evaluating the optimal time to exit an investment and reinvest the capital into new opportunities.

The Connected Planning framework enables teams to run more meaningful, forward-looking analysis with "what-if" analysis that helps assess portfolio performance and how macro-economic changes could impact performance, margins and even share price.

By engaging teams in a collaborative planning cycle—one that seamlessly connects bottom-up and top-down planning—business leaders can improve and gain more from company intelligence. Planning cycles are cut from months to days with far greater transparency and visibility into trends and outliers. Further, plans demonstrate thoughtful, intelligent, and meaningful analysis to help ensure that quarterly and annual results are achieved.

Vendors Addressing Connected Planning for Commercial Real Estate

There are a number of vendors whose products are being used within the commercial real estate sector to provide enhanced planning and modeling. Real estate clients are using these platforms across lease and property budgeting and forecasting, portfolio modeling, development CapEx planning, space forecasting, investment and fund modeling and debt, tax and corporate allocations, as well as marketing, HR, and treasury functions.

Adopters of specialist cloud-based planning solutions include Aviva Investors, Blackstone, British Land, Colony Capital, Courtland, GPT Group, Invitation Homes, Logicor, Prologis, Simon Property Group, and Vicinity Centres.

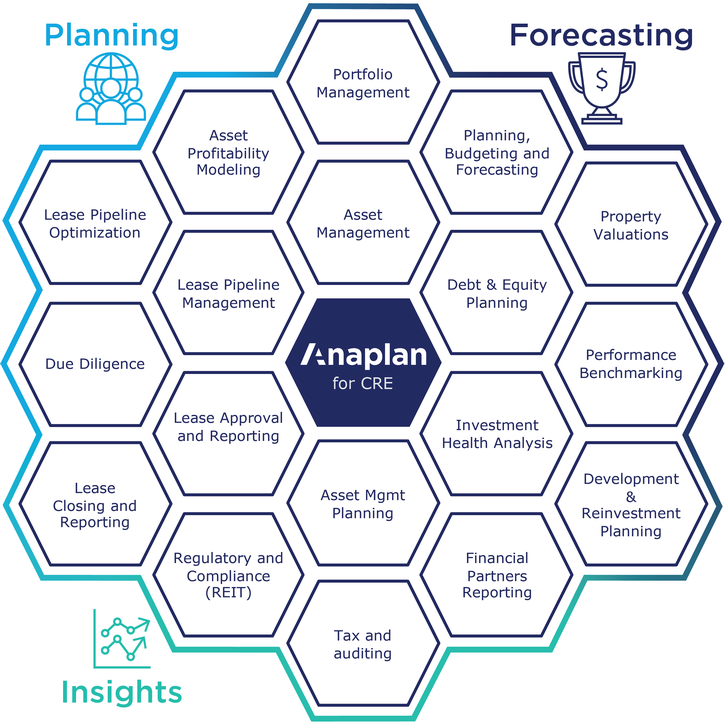

Anaplan (NYSE: PLAN), a leading Connected Planning technology company, offers a dynamic, collaborative, and intelligent platform to help companies make quicker and more informed decisions, which in turn drives faster, more effective planning across the enterprise. Anaplan’s platform helps business leaders solve planning, forecasting, and reporting challenges in many different areas of the organization—whether it's property specific analytics or related to finance, operations, HR, or marketing. More than just the redesign of a particular process, the most significant benefits provided by the platform reside in the business synergies achieved by connecting the models across lines of business to improve business insights and make faster decisions.

Adaptive Insights, recently purchased by Workday, is another planning solution that focuses on corporate Financial Planning and Analytics (FP&A) as well as financial consolidations. Connectivity with the Workday ERP platform enables integrated, real-time impact analysis and scenario flexing not seen with traditional industry tools.

Other niche vendors who have expanded their offerings to real estate include Host Analytics, BOARD International, Vena and CCH Tagetik. Traditional real estate software vendors are also focusing on cloud-based planning, with Altus acquiring Taliance and releasing a new cloud-based offering of ARGUS Enterprise, Yardi enhancing their ABF and Forecast Manager modules, and MRI upgrading their core platform and enhancing their Investment Management suite.

The commercial and investment real estate industries are the real winners with this enhanced focus on Connected Planning!

Learn about new leading-edge solutions, including connected planning, which will be presented at Realcomm | IBcon 2019. The event will be held at the Nashville Music City Center on June 13 & 14 (Golf and RE Tech Tours June 11 | Pre-Con Events: June 12). Register today!

This Week’s Sponsor

Yardi® develops and supports industry-leading investment, property management and energy management software for all types and sizes of real estate companies. For the energy market, the Yardi Pulse® Suite helps manage costs, consumption and sustainability initiatives. Yardi is based in Santa Barbara, Calif., and serves clients worldwide. For more information on how Yardi is Energized for Tomorrow, visit yardi.com.

Read Next

4/18/2024

4/18/2024

Best Practices for Managing Lease Renewals When your commercial leases come up for renewal, it’s a great opportunity to assess your real estate portfolio, consider the value of current leases and possibly negotiate better terms.

4/11/2024

4/11/2024

3 Reasons to Incorporate AI Into Your Talent Retention Strategy Introducing new technology into the workplace is often met with suspicion.

4/4/2024

4/4/2024

Operational Technology (OT) Data Data has been a cornerstone of business since the early days of computing in the 1960s.

3/28/2024

3/28/2024

The Tech-Forward Response to Rising CRE Cap Rates is Also People-First Cap rates on commercial real estate have been rising for five consecutive quarters, leading to an estimated 20% drop in value for many property types, according to CBRE’s latest U.S. Real Estate Market Outlook.

.jpg)